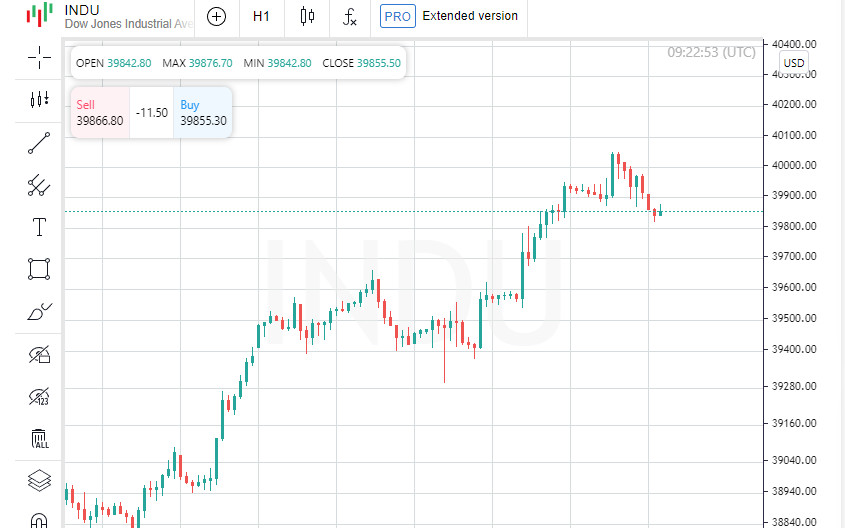

The milestone for the Dow coincided with other key indexes setting new records, the S&P 500 (.SPX) and Nasdaq Composite (.IXIC) also hitting all-time highs this week. The gains reflect growing investor confidence in the U.S. economic outlook, suggesting the country could achieve a so-called "soft landing."

Investors believe the Federal Reserve can contain inflation without significantly hurting economic growth.

According to the latest data from LSEG IBES, published on May 10, the current earnings season was also better than expected, with 77% of companies beating analysts' forecasts, compared with 67% in the previous period, helping stocks rise.

The components of the Dow Jones Industrial Average are weighted based on their stock prices, unlike the S&P 500, where individual stocks are weighted based on their market value. This weighting technique may cause the Dow Jones Industrial Average to adjust more slowly to include new popular companies.

According to the S&P Dow Jones Indices' annual asset survey through December 2023, approximately $89 billion of investments were tied to the Dow Jones Industrial Average, while the S&P 500 Index had $11.45 trillion in assets tied to it.

However, despite its focus on stock price, the Dow retains a significant cultural heritage. Founded in 1896, it is significantly older than other major indices such as the S&P 500, which was launched in 1957, and the Nasdaq, launched in 1971. Over the past 20 years, the Dow Jones Industrial Average has outperformed the S&P 500 eight times. This year, the Dow Jones Industrial Average is up 5.8%, while the S&P 500 is up 11.1% and the Nasdaq is up 11.2%. .

"The Dow is the symbol of America," said Quincy Crosby, chief global strategist at LPL Financial. "Many experts have lost interest in it, but this index still represents Main Street America." At the end of trading on Thursday, the index closed at 39,869.38 after falling in the afternoon.

After reaching the 10,000 mark, the Dow Jones Industrial Average experienced rapid growth, although market participants cannot clearly pinpoint the reason for this impulse.

The index's average monthly gain after breaking 10,000 points was 4.3%, significantly higher than the average monthly gain of 0.57% recorded since the index's inception in May 1896.

The Dow Jones Industrial Average's recent hit of 40,000 came just over three years after it hit 30,000.

This interval was filled with significant market fluctuations caused by the impact of the COVID-19 pandemic, rising inflation and the Federal Reserve's response, which raised interest rates to stabilize rising consumer prices.

The composition of the Dow Jones Industrial Average differs markedly from the S&P 500 due to differences in the selection and weighting of index components.

For example, as of the last close of trading on Wednesday, UnitedHealth Group (UNH.N), the top-ranked stock in the Dow Jones, was the thirteenth-largest stock in the S&P 500. The second-largest stock in the Dow, Goldman Sachs (GS.N) isn't even in the top 50 of the S&P 500.

In contrast, leading tech giants like Nvidia (NVDA.O), Alphabet (GOOGL.O) and Meta Platforms (META.O), which are among the top six companies on the S&P 500, are not represented in the Dow.

Shares of GameStop (GME.N) and AMC (AMC.N), which are popular among retail investors, fell for a second straight day on Thursday amid increased activity on social media. The return to the Internet of "Roaring Kitty", a key character in the meme campaigns of 2021, has contributed to the fading of interest in this phenomenon.

Shares of video game retailer GameStop fell 30% to close at $27.67 after jumping to $64.83 on Tuesday. Shares of the movie theater chain AMC closed with a loss of 15.3%, reaching $4.64.

Both companies faced sharp declines after rising in the first two sessions of the week, fueled by a series of messages from Keith Gill, known online as "Roaring Kitty." His enthusiasm for GameStop stock in 2021 sparked a massive craze for meme stocks.

In a change from 2021, when Reddit users bought heavily shorted stocks in droves, fueling bets against hedge funds, this time institutional investors also joined the meme stocks, said Vanda Research, a company that tracks retail investor flows.

Meanwhile, hedge fund Renaissance Technologies reportedly increased its bets on GameStop shares and significantly increased its long-term position in AMC in the first quarter.

GameStop shares have lost more than 70% of their value from their 2021 intraday high, while AMC shares have fallen 99% from their all-time peak.

Former SEC Chairman Jay Clayton told CNBC on Wednesday that such events have caused "a wave of euphoria and speculative buying among retail traders, which rarely ends well."

In addition to this, other stocks that have also posted significant gains this week experienced declines on Thursday. Shares of Tupperware (TUP.N) fell nearly 8%, while U.S.-traded shares of BlackBerry were down about 6%.