Analysis of Macroeconomic Reports:

There are only a few macroeconomic reports scheduled for Wednesday, and only one is of particular interest—the UK inflation report. It is expected that the Consumer Price Index (CPI) will decrease to 3.4-3.5%, allowing the Bank of England to implement another easing of monetary policy tomorrow. Novice traders should remember that an easing of policy is a "bearish" factor for the currency. However, if inflation does not fall to 3.5% or rise by the end of November, the prospect of lowering the key interest rate on Thursday will be called into question. In this case, the British pound could significantly appreciate throughout the day.

In the Eurozone, the second estimate of November inflation will be published today, which is of little significance. The second estimate rarely differs from the first, and the issue of stabilizing inflation is not currently a pressing concern for the European Central Bank. In the US, the event calendar is empty today.

Analysis of Fundamental Events:

Several key events are scheduled for Wednesday, all of which feature speeches by members of the FOMC. It is worth noting that the last Federal Reserve meeting took place last week, during which the key interest rate was lowered, and the Fed adopted a wait-and-see approach regarding further easing. However, yesterday's labor market and unemployment data, along with tomorrow's inflation report, could significantly affect the mood of many Fed officials. Therefore, market participants should closely monitor the speeches from representatives of the US central bank in the coming days.

General Conclusions:

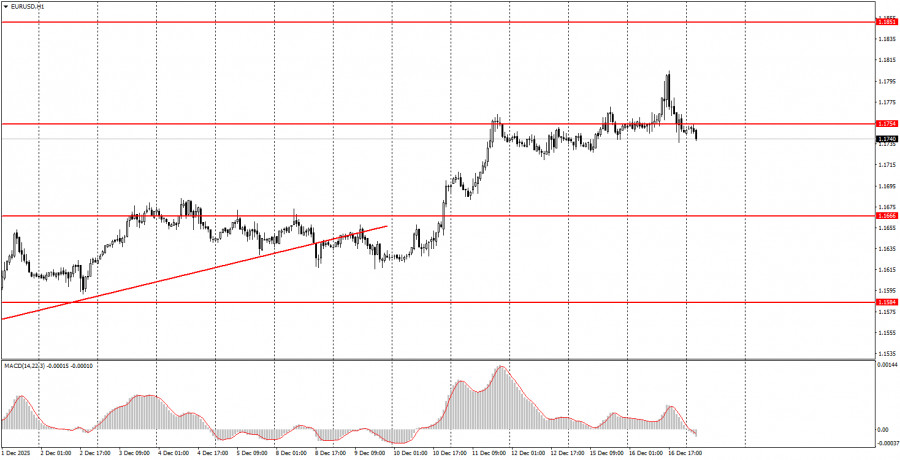

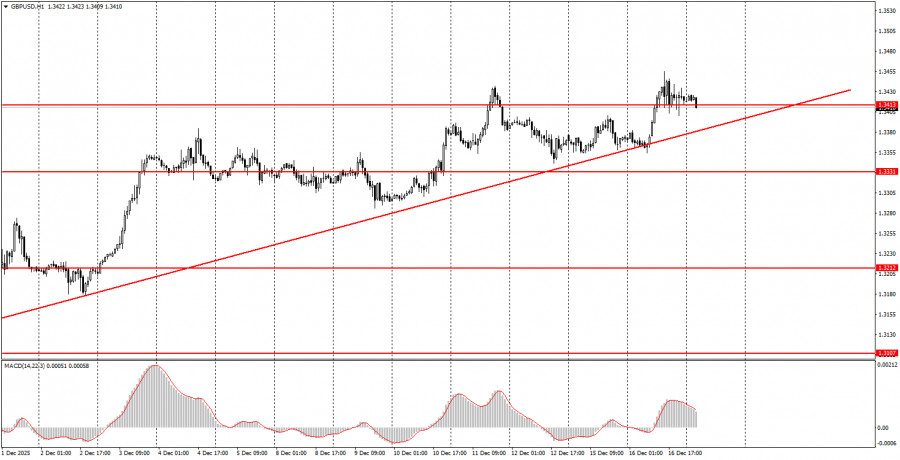

On the third trading day of the week, both currency pairs may again trend towards growth, as the upward trend continues in both cases. The fate of the British pound today will depend on the inflation report, while both pairs will generally trade from the nearest technical levels and areas. For the euro, this is the area of 1.1745-1.1754, and for the pound, it is the area of 1.3413-1.3421.

Key Rules of the Trading System:

- The strength of a signal is determined by the time it takes to form the signal (bounce or breakout). The less time it takes, the stronger the signal.

- If two or more trades were opened near a certain level based on false signals, all subsequent signals from that level should be ignored.

- In a flat, any pair can form a multitude of false signals or none at all. At the first signs of a flat, it is better to stop trading.

- Trades are opened during the time between the start of the European session and mid-American session, after which all trades should be closed manually.

- On the hourly timeframe, using signals from the MACD indicator, it is preferable to trade only when good volatility exists, and a trend is confirmed by a trend line or channel.

- If two levels are too close to each other (5 to 20 pips), they should be viewed as an area of support or resistance.

- After moving 15-20 pips in the right direction, a Stop Loss should be set to breakeven.

Chart Explanations:

- Support and Resistance Levels: Levels that serve as targets for opening buys or sells. Take Profit levels can be placed near them.

- Red Lines: Channels or trend lines that reflect the current trend and indicate the preferred direction to trade.

- MACD Indicator (14, 22, 3): A histogram and signal line, a supplementary indicator that can also be used as a source of signals.

Important Note: Significant speeches and reports (always included in the news calendar) can greatly influence the movement of the currency pair. Therefore, during their release, it is advisable to trade cautiously or exit the market to avoid sharp reversals against the preceding movement.

Remember: For beginners trading in the Forex market, it is crucial to understand that not every trade can be profitable. Developing a clear strategy and implementing sound money management are keys to successful long-term trading.