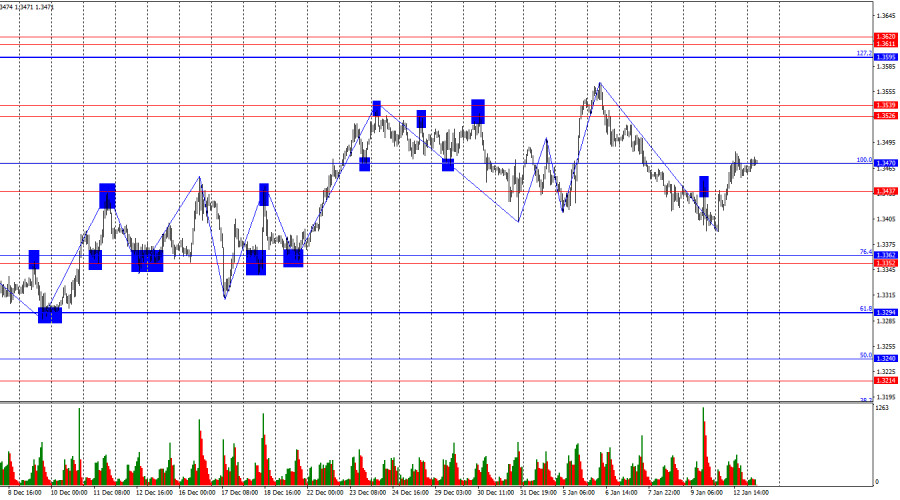

On the hourly chart, GBP/USD reversed in favor of the British pound on Monday and returned to the 1.3437–1.3470 level, around which trading has been concentrated over the past three weeks. A sustained move above this area would allow traders to expect further growth toward the resistance zone at 1.3526–1.3539. A consolidation below the zone, by contrast, would point to a decline toward 1.3352–1.3362.

The wave structure remains bullish. The most recently completed upward wave exceeded the previous high, while the new downward wave broke the prior low by only a few pips—insufficient to invalidate the prevailing trend. The fundamental backdrop for the pound has been weak in recent weeks, but the US news flow has also been far from supportive. Bears have been on the offensive in recent days, but a breakdown of the bullish trend would only occur below the 1.3403 level.

Monday's news flow supported the bulls, who had been largely inactive throughout the previous week. It is worth recalling that several important reports were released in the US last week, and only the ISM Services PMI favored the bears. In all other cases, bulls had ample opportunity to go on the offensive but failed to do so. However, at the start of the new week, the Donald Trump administration leveled accusations against FOMC Chair Jerome Powell, triggering a sharp retreat by bears from the market. In my view, renewed pressure from Trump on the Federal Reserve this year is unlikely to have a positive impact on the US dollar. Its decline could continue on Tuesday.

Today, the US will publish inflation data, which could also force bears to continue retreating. In November, the Consumer Price Index slowed to 2.7%, but I believe this was a temporary phenomenon caused by seasonal promotional activity. Most likely, December figures will show renewed growth in consumer prices. This would be relatively supportive for the dollar, as elevated inflation would prevent the Fed from continuing monetary easing. However, entirely different issues are currently dominating the agenda.

On the 4-hour chart, the pair has returned to the support level at 1.3369–1.3435. A rebound from this area would once again favor the pound and a resumption of growth toward the next Fibonacci level at 127.2% (1.3795). A sustained move below the 1.3369–1.3435 level would allow traders to expect a reversal in favor of the US dollar and a decline toward the support level at 1.3118–1.3140. No emerging divergences are observed at this time.

Commitments of Traders (COT) Report

Sentiment among non-commercial traders became more bullish over the latest reporting week. The number of long positions held by speculators increased by 6,994, while short positions rose by 4,325. The gap between long and short positions now stands at approximately 76,000 versus 107,000 and is narrowing rapidly. Bears have dominated in recent months, but the pound appears to have largely exhausted its downward potential. At the same time, the situation in euro contracts is the exact opposite. I still do not believe in a sustained bearish trend for the pound.

In my view, the pound remains less "risky" than the US dollar. In the short term, the US currency may occasionally benefit from demand, but not over the long term. Donald Trump's policies have led to a sharp deterioration in the labor market, forcing the Federal Reserve to ease monetary policy in order to curb rising unemployment and stimulate job creation. US military aggression also does little to boost optimism among dollar bulls.

Economic Calendar: US and UK

- US — Consumer Price Index (13:30 UTC)

- US — New Home Sales (13:30 UTC)

On January 13, the economic calendar contains two releases, one of which is considered significant. The impact of the news flow on market sentiment is expected in the second half of the day.

GBP/USD Forecast and Trading Recommendations

Selling the pair may be considered today on a rebound from the 1.3437–1.3470 level on the hourly chart, with targets at 1.3352–1.3362. Buying opportunities may be considered if prices consolidate above the 1.3437–1.3470 level on the hourly chart, targeting 1.3526–1.3539.

Fibonacci grids are drawn from 1.3470 to 1.3010 on the hourly chart and from 1.3431 to 1.2104 on the 4-hour chart.