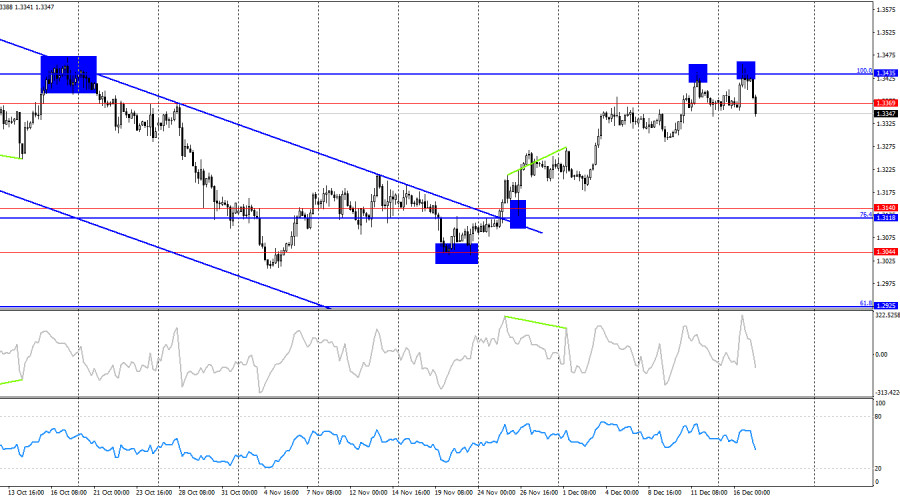

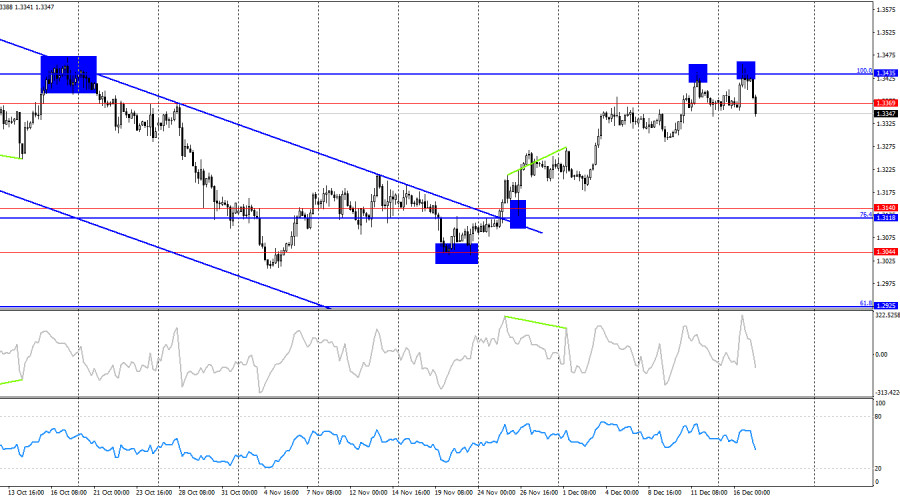

On the hourly chart, the GBP/USD pair rose to the 1.3425 level on Tuesday, rebounded from it, reversed in favor of the U.S. dollar, and fell below the support level of 1.3352–1.3362. Thus, the decline in prices may continue today toward the next levels at 1.3294 and 1.3240.

The wave situation turned bullish several weeks ago, but over the course of today it has shifted back to bearish. The last completed upward wave broke the previous peak by only a few points, while the new downward wave managed to break the previous low. The news background for the pound has been weak in recent weeks, but the bears have fully worked it out, and the information backdrop in the U.S. also leaves much to be desired. However, this week, not-so-positive data from the UK have begun to come in again, significantly increasing the chances of further easing of the Bank of England's monetary policy.

The news background on Wednesday triggered sharp bullish attacks due to weak U.S. labor market and unemployment reports. However, the UK also released reports yesterday on unemployment, the labor market, and wages. The unemployment rate rose in the UK as well, but traders focused on U.S. statistics. This morning, however, the UK inflation report was released, forcing the bulls to flee the market in haste. The Consumer Price Index fell to 3.2% year-on-year instead of the expected 3.5%, and core inflation dropped to 3.2% year-on-year. Thus, I can confidently say that tomorrow the Bank of England will decide on another round of monetary easing. Against the backdrop of this event, the pound is losing ground, while the bears feel a surge of strength and move into a full-scale offensive. I do not know how long this offensive will last, as there will be many more important events and reports this week. Even the Bank of England meeting itself may end quite unexpectedly. In the U.S., an inflation report is due, which may also adjust traders' expectations. Today the pound is plunging; tomorrow it could be the dollar that plunges.

On the 4-hour chart, the pair completed a second rebound from the 100.0% corrective level at 1.3435, reversed in favor of the U.S. dollar, and began falling toward the 1.3140 level. A consolidation of the pair above 1.3435 would allow expectations of further growth toward the Fibonacci 127.2% level at 1.3795. No emerging divergences are observed on any indicator today.

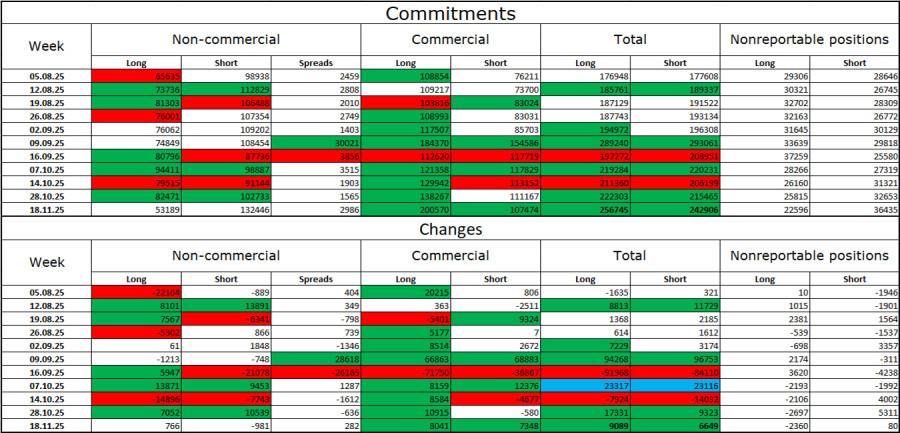

Commitments of Traders (COT) Report

The sentiment of the "Non-commercial" category of traders did not change over the latest reporting week; however, this reporting week was a month ago—dated November 18. The number of long positions held by speculators increased by 766, while the number of short positions decreased by 981. The gap between the number of long and short positions is currently effectively as follows: 53,000 versus 132,000. As we can see, bears dominated a month ago, but the situation may now be completely different. In the euro, it was already the opposite even a month ago. Therefore, I do not believe that the market in the pound is currently bearish.

In my view, the pound still looks less "dangerous" than the dollar. In the short term, the U.S. currency occasionally enjoys demand in the market, but I believe this is a temporary phenomenon. Donald Trump's policies have led to a sharp deterioration in the labor market, and the Federal Reserve is forced to ease monetary policy in order to stop the rise in unemployment and stimulate the creation of new jobs. For 2026, the FOMC does not plan aggressive monetary easing, but at present no one can be sure of this, because labor market statistics are still unavailable.

News Calendar for the U.S. and the UK

United Kingdom – Consumer Price Index (07:00 UTC).

On December 17, the economic calendar contains only one entry, but this release may prove decisive for tomorrow's Bank of England meeting. The impact of the news background on market sentiment on Wednesday could be strong, especially in the first half of the day.

GBP/USD Forecast and Trading Advice

Sell positions could be opened after a rebound from the 1.3425 level on the hourly chart, with a target at 1.3352–1.3362. A close below this zone would allow traders to keep positions open with targets at 1.3294 and 1.3240. Today, I recommend considering buy positions only on rebounds from the nearest support levels.