Trade Analysis and Trading Tips for the European Currency

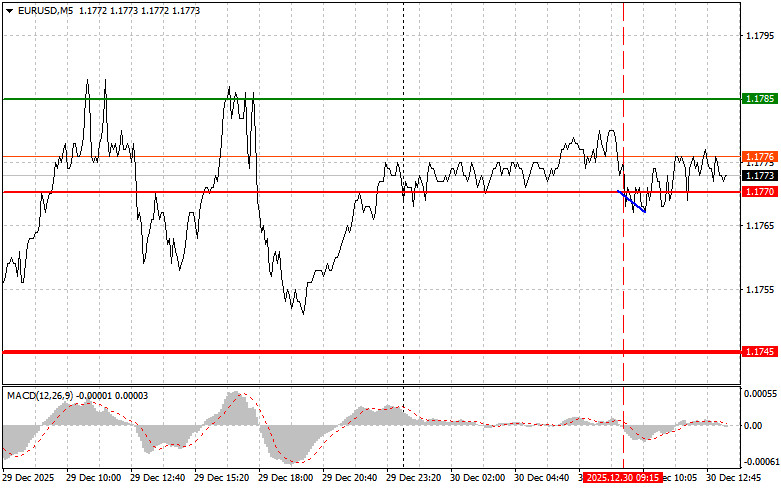

The test of the 1.1770 price level occurred when the MACD indicator was just beginning to move downward from the zero line, which confirmed a correct entry point for selling the euro. However, this did not result in a major decline.

The pre-holiday calm in Europe has affected EUR/USD fluctuations, locking the pair within a narrow range. Market participants, absorbed in the holiday mood, are showing restraint, refraining from active actions and risky trades.

In the second half of the day, updated data on the S&P/Case-Shiller Home Price Index for the 20 largest cities, as well as the Chicago Purchasing Managers' Index (Chicago PMI), could attract attention and revive trading. In addition, the report from the latest Federal Reserve meeting will be released. These events are likely to act as sparks that may reignite activity in markets that have gone quiet ahead of the holidays.

However, the most important event will be the publication of the FOMC meeting minutes. This report will give market participants an opportunity to examine in detail the reasoning behind the regulator's recent decisions. Investors will look for clues about future monetary policy and assess the Fed's intentions regarding further interest rate cuts.

As for the intraday strategy, I will mainly rely on the implementation of Scenarios No. 1 and No. 2.

Buy Signal

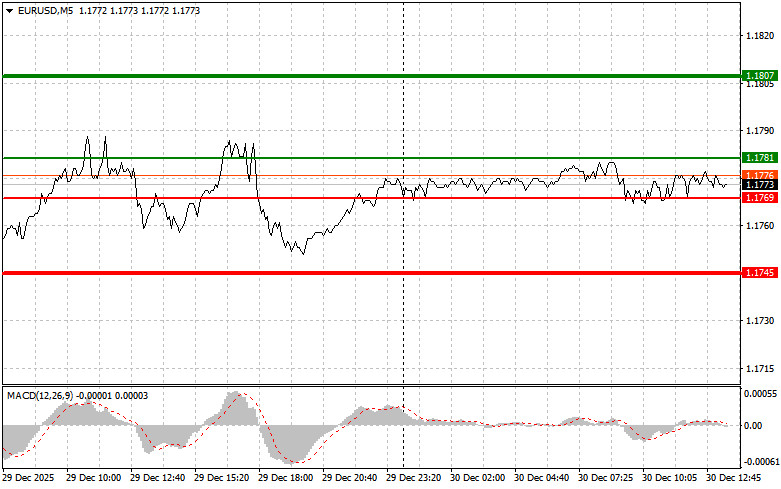

Scenario No. 1: Today, buying the euro is possible if the price reaches the 1.1781 level (green line on the chart), with a target of growth toward the 1.1807 level. At 1.1807, I plan to exit the market and also sell the euro in the opposite direction, expecting a move of 30–35 points from the entry point. Strong euro growth can be expected within the trend following weak U.S. data.Important! Before buying, make sure the MACD indicator is above the zero line and is just starting to rise from it.

Scenario No. 2: I also plan to buy the euro today if there are two consecutive tests of the 1.1769 price level while the MACD indicator is in the oversold zone. This will limit the pair's downward potential and lead to a reversal upward. A rise toward the opposite levels of 1.1781 and 1.1807 can be expected.

Sell Signal

Scenario No. 1: I plan to sell the euro after the price reaches the 1.1769 level (red line on the chart). The target will be the 1.1745 level, where I intend to exit the market and immediately buy in the opposite direction (expecting a move of 20–25 points in the opposite direction from that level). Strong pressure on the pair is unlikely to return today.Important! Before selling, make sure the MACD indicator is below the zero line and is just starting to decline from it.

Scenario No. 2: I also plan to sell the euro today if there are two consecutive tests of the 1.1781 price level while the MACD indicator is in the overbought zone. This will limit the pair's upward potential and lead to a reversal downward. A decline toward the opposite levels of 1.1769 and 1.1745 can be expected.

What's on the Chart

- Thin green line – entry price at which the trading instrument can be bought;

- Thick green line – projected price where Take Profit orders can be placed or profits can be taken manually, as further growth above this level is unlikely;

- Thin red line – entry price at which the trading instrument can be sold;

- Thick red line – projected price where Take Profit orders can be placed or profits can be taken manually, as further decline below this level is unlikely;

- MACD indicator – when entering the market, it is important to consider overbought and oversold zones.

Important: Beginner Forex traders should be extremely cautious when making market entry decisions. Ahead of major fundamental reports, it is best to stay out of the market to avoid sharp price swings. If you decide to trade during news releases, always place stop-loss orders to minimize losses. Without stop-loss orders, you can lose your entire deposit very quickly, especially if you do not use money management and trade large volumes.

And remember, successful trading requires a clear trading plan, such as the one presented above. Making spontaneous trading decisions based solely on the current market situation is inherently a losing strategy for an intraday trader.