Trade review and trading tips for the euro

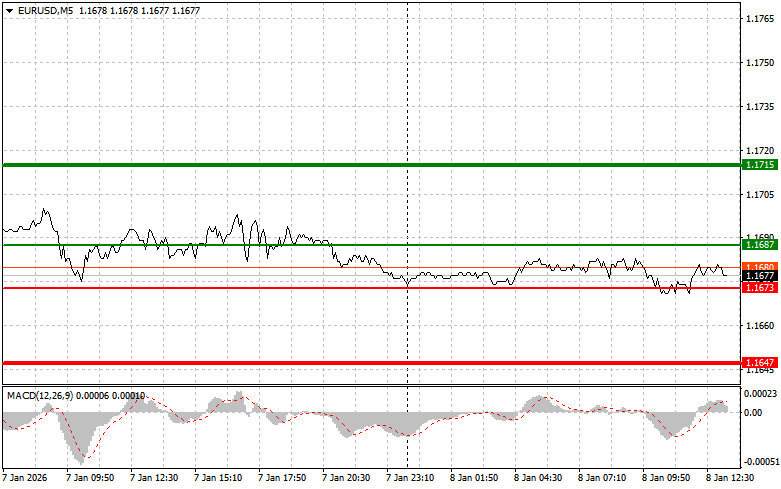

A test of the 1.1677 price level occurred when the MACD indicator was just starting to move down from the zero line, which confirmed a correct entry point for selling the euro. As a result, the pair declined by only 7 points.

Producer prices in the eurozone rose, while the unemployment rate fell. At first glance, this would seem like a good reason to buy the European currency. However, traders sometimes display remarkable selectivity, and the euro's behavior in this case is a clear example. Despite positive signals from the eurozone economy, the single currency remained largely indifferent, showing neither growth nor any noticeable weakening.

I hope that after midday we will see a period of higher activity. The main event will be the release of the weekly U.S. initial jobless claims report. This indicator is traditionally considered a key gauge of the health of the U.S. labor market and can significantly affect the value of the dollar. Along with the labor market situation, close attention will also be paid to the U.S. trade balance. A negative trade balance is a persistent issue for the U.S. economy, and any narrowing of the deficit is viewed as a positive sign. To conclude the day, data on U.S. consumer credit will be released. An increase in this indicator suggests that Americans are confident in their financial situation and continue to spend actively, which is an important driver of economic growth. On the other hand, excessive growth in household debt may pose risks in the longer term.

As for the intraday strategy, I will mainly rely on the implementation of scenarios No. 1 and No. 2.

Buy Signal

Scenario No. 1: Today, buying the euro is possible if the price reaches the 1.1687 area (green line on the chart), with a target at 1.1715. At 1.1715, I plan to exit the market and also sell the euro in the opposite direction, aiming for a 30–35 point move from the entry point. A strong rise in the euro can be expected only after weak U.S. data.Important! Before buying, make sure that the MACD indicator is above the zero line and is just starting to rise from it.

Scenario No. 2: I also plan to buy the euro today in the event of two consecutive tests of the 1.1673 level when the MACD indicator is in oversold territory. This would limit the pair's downward potential and lead to a reversal upward. A move toward the opposite levels of 1.1687 and 1.1715 can be expected.

Sell Signal

Scenario No. 1: I plan to sell the euro after the price reaches the 1.1673 level (red line on the chart). The target will be 1.1647, where I intend to exit the market and immediately buy in the opposite direction, aiming for a 20–25 point move from the level. Downward pressure on the pair may return at any moment.Important! Before selling, make sure that the MACD indicator is below the zero line and is just starting to decline from it.

Scenario No. 2: I also plan to sell the euro today in the event of two consecutive tests of the 1.1687 level when the MACD indicator is in overbought territory. This would limit the pair's upward potential and lead to a reversal downward. A decline toward the opposite levels of 1.1673 and 1.1647 can be expected.

What's on the chart:

- Thin green line – the entry price at which the trading instrument can be bought;

- Thick green line – the projected price level where Take Profit orders can be placed or profits can be taken manually, as further growth above this level is unlikely;

- Thin red line – the entry price at which the trading instrument can be sold;

- Thick red line – the projected price level where Take Profit orders can be placed or profits can be taken manually, as further decline below this level is unlikely;

- MACD indicator – when entering the market, it is important to rely on overbought and oversold zones.

Important: Beginner Forex traders should be extremely cautious when making market entry decisions. Ahead of major fundamental reports, it is best to stay out of the market to avoid sharp price swings. If you decide to trade during news releases, always place stop-loss orders to minimize losses. Without stop orders, you can lose your entire deposit very quickly, especially if you do not use proper money management and trade large volumes.

And remember, successful trading requires a clear trading plan, similar to the one presented above. Making spontaneous trading decisions based solely on the current market situation is an inherently losing strategy for an intraday trader.